Engagement & Retention project | Groww

Groww: Engagement & Retention

FYI - Mutual fund & Stock investments are subject to market risks

Let's Begin!

Absolutely! Let’s dive in and Groww together! 🌱 Ready to turn those investment dreams into reality? 🚀💸

Core Value Proposition:

- ‘To simplify investing and personal finance for all Indians, making wealth creation accessible to everyone.’

Why choose Groww? 🤔

Product Selection Framework

| Criteria | Response |

|---|---|

Internet-first product | Yes ☑️ |

Content flywheel driven | Yes ☑️ |

Post PMF? | Yes ☑️ |

Scale of operations | 45M+ users registered |

Retention? | 60% of users are MAU 45% of MAU use the app daily The average session duration is ≥ 5 minutes |

Revenue | $150 million + annual revenue (2023) |

Retention metrics are based on industry benchmarks, as specific data is not publicly available.

Groww is a key player in the fintech space; however, it is crucial to understand WHY focusing on Groww India is significant:

In just 9 years, Groww has risen to become India’s leading brokerage platform.

- India is a Major Market for Groww:

- Over 151 million registered Demat accounts in India, showcasing substantial market penetration.

- India is a key market for Groww, with a significant user base and high engagement. Additionally, the platform attracts 2 million visitors from other countries, underscoring its importance in the company's global strategy.

- Rapid Growth and Expansion:

- 8x revenue growth in the past 5 years, indicating a robust and expanding market presence in India.

- Significant user adoption and increasing financial literacy are driving this growth.

Groww has evolved from a basic investment platform (focused on mutual funds) to a comprehensive fintech app (offering stocks, gold, fixed deposits, and more).

This evolution is now reflected in Groww's positioning and app description: “Groww: Invest in Stocks, Mutual Funds & More”.

How does Groww achieve this?

- User-friendly platform: Simplified UI/UX for seamless investing in stocks, mutual funds, gold, and more.

- Transparency: No hidden charges, clear communication on fees and returns.

- Educational resources: Groww Academy, blogs, and videos aimed at demystifying financial concepts for all.

- Wide product range: From mutual funds and stocks to US stocks, fixed deposits, and ETFs—all accessible through the app.

- Bottomline: Groww democratizes investing by making it easy for first-time investors and seasoned traders alike to access a wide range of financial products.

Note - Groww's US stock investment service was discontinued due to government policy change

How do users experience it repeatedly?

- Investing and managing portfolios: Users can buy/sell mutual funds, stocks, etc., and monitor both stock & Mutual fund portfolios through the app.

- Engaging with educational content: Through the Groww blog, webinars, and YouTube videos.

- Tracking market trends: Real-time notifications on stock market movements and personal investments.

The Natural frequency of the core value proposition:

- Casual users: Once every few months for occasional investments or portfolio reviews.

- Core users: Several times a month for tracking, buying, and rebalancing their portfolio.

- Power users: Monitor markets and trade stocks daily or multiple times a week and explore new investment opportunities.

Product X Frequency

Product Categories | Stocks | Mutual Funds | ETFs | Gold | Fixed Deposits | Educational Content |

Contains | Equity Shares, Blue-Chip Stocks, IPOs | Equity Mutual Funds, Debt Mutual Funds, Hybrid Funds | Index Funds, Sectoral ETFs | Gold ETFs, Sovereign Gold Bonds | Bank Fixed Deposits, Company Fixed Deposits | Groww Academy, Investment Guides, Market Analysis |

JTBD | Investing in individual companies for potential high returns | Diversified investment to spread risk and seek returns | Investing in diversified portfolios through ETFs | Safe and stable investment in precious metals | Secure investment with guaranteed returns | Educational resources to simplify investing and personal finance |

Casual | Once every 1-2 months | Once every 3-4 months | Once every 2-3 months | Once every 3-4 months | Once every 5-6 months | Once every 3-4 months |

Core | Once/twice a week | Twice a month | Twice a month | Twice a month | Twice a month | Twice a month |

Power | 3-4 times a week | Twice a week | Twice a week | Twice a week | Once in two week | Once a week |

User Flywheel

Real money flywheel

Ideal Framework

| Framework | New Feature | Depth | Frequency |

|---|---|---|---|

Description | AI Chatbot & News Tab | AI-Driven Technical Insights | - |

Objective | Enhance user experience with AI-driven support and timely news updates | Provide in-depth, evolving insights to power users based on AI learning | - |

Implementation | - Integrate AI chatbot for real-time support and queries - Add a News tab for market updates and investment news | - Develop AI-driven insights for advanced analysis - Continuously improve insights based on user interaction and data | - |

Benefits | - Immediate assistance and improved user experience & solving real-time tickets - Access to current market news and trends to make better decisions in real-time as | - Deeper understanding of market trends and investments - Personalised insights that evolve with user behaviour | - |

Metrics for Success | - User adoption rates of AI chatbot and News tab - User feedback and satisfaction | - Accuracy and relevance of insights provided - Improvement in user investment decisions over time | - |

Problem Statement which we are Solving | App glitches over Stock order placed, balance etc | Daily traders prefer Zerodha over Groww due to the advanced technical indicators available for day trading. | |

Based on this understanding we will go ahead with a new feature & depth framework

Core E&R Metrics

Actions of Active Users for Groww:

Actions that define an active user:

A minimum of 1 transaction in Stocks/ETF in the last 30 days or once a month for SIP and Mutual fund

Natural Frequency of Usage for Groww Users:

Casual Users

- Frequency - Once in a month

- Behaviour: Typically long-term investors with sporadic activity.

- Primary focus on safer assets like mutual funds or ETFs, SIP, Mutual funds, Large Cap companies stocks

- Limited exploration of advanced features and market insights.

- Profile: Part-time freelancers, businessmen or individuals looking to diversify their income with minimal effort.

E.g.: New users or those who make small, passive investments and only occasionally check their portfolios.

Core Users:

- Frequency: Twice a week.

- Behaviour: Regular investors with a moderate level of engagement.

- Have explored a variety of asset classes (stocks, bonds, mutual funds) and regularly check portfolio performance.

- Use insights and market updates to make informed decisions.

- Profile: Working professionals seeking to grow their wealth with more regular investments and a balanced portfolio.

E.g.: Users who invest in stocks or mutual funds bi-weekly and frequently use the platform to check the market sentiment.

Power Users:

- Frequency: Once/twice a week or more.

- Behaviour: Active traders and high-frequency investors with a deep understanding of markets.

- Engage heavily with advanced tools like technical indicators, real-time data, and AI-driven insights.

- Explore the full range of Groww's offerings, including daily trading, SIPs, and alternative investments.

- Profile: Financially savvy professionals or active traders who manage multiple income sources and optimize returns through frequent trading.

E.g.: Users who actively manage a diverse portfolio and engage with insights or trade frequently across multiple asset classes.

From Casual User to Core User

Customer Segmentation

Groww ICP Framework:

ICP | "The Side-Hustler" | "The Safety-Seeker" | "The Market Maverick" |

Who | Working Professional diversifying into stocks | Mid-career professional looking for safe, low-risk investments | Full-time trader or experienced investor |

Age | 21-25 | 26-45 | 25-40 |

Gender | Male | Male/Female | Male/Female |

City | Bangalore, Mumbai | Delhi NCR, Pune | Tier 1 cities - Mumbai, Delhi, Kolkata |

Job Title | Software Developer, Digital Marketer, Consultant | Manager, Accountant, Corporate Employee | Business Owner, Stock Broker, Full-time Trader |

Income Range | 10-20 LPA | 15-30 LPA | 30-50 LPA |

Marital Status | Unmarried or Newly Married | Married with Kids | Married/Single |

Mode of Transport | Uber, Metro, Own Bike | Own Car, Metro | Luxury Car, Own Vehicle |

Daily Investment Habit | Sporadic, based on trending news or hearsay | 1-2 times a week, based on long-term plans | Daily, with frequent checks on stock performance |

Preferred Investment Products | Stocks, Mutual Funds, SIP | Fixed Deposits, Mutual Funds, Insurance, SIP, Long term Stocks | Stocks, Options, Futures, Crypto |

Investment Frequency | Once in 2 weeks | Once a month | Each trading day |

Primary Financial Goal | Build side income, diversify savings | Secure future, children's education | Maximize returns, wealth growth |

Risk Appetite | Moderate | Low | High |

Preferred Investment Style | "Set-it-and-forget-it" approach | Conservative with a diversified portfolio | Active trading with in-depth analysis |

Commonly Used Social Media | Twitter, Instagram, LinkedIn | Facebook, LinkedIn, YouTube | Twitter, YouTube, Reddit |

OTT/Streaming Apps | Netflix, Prime Video | Netflix, Hotstar | Bloomberg TV, CNBC, YouTube |

Shopping Habits | Amazon, Flipkart | Amazon, BigBasket | Rare online shopping, more invested in stocks than consumer goods |

Influences/Advisors | Friends, Twitter personalities | Financial planners, CA, conservative media | Online trading communities, stock experts, HNI & VC groups |

JTBD | Quick, hassle-free investments | Secure returns for long-term plans | In-depth analytics, power trading tools |

Preferred Content | Short-form, news-driven investment insights | Long-form, educational financial planning content | Detailed reports, charts, and technical analysis |

Hobbies | Exploring side hustles, learning about personal finance | Family time, occasional reading | Reading financial news, trading strategies |

AOV per Investment | Rs. 10,000 - Rs. 50,000 | Rs. 1 lakh+ to 10 Lakh | Rs. 5 lakh+ Goes up to 1cr or more |

Investment Channels | Groww App, YouTube Finance Channels | Financial Advisors, Groww App | Trading Platforms, Financial News Sites |

Pain Points | Lack of time, unclear on advanced investing tools | Uncertain about stock market risks, prefers conservative growth | Needs advanced technical tools, faster execution |

What drives retention? | Ease of app use, quick results | Secure investment options, long-term reliability | Technical features, real-time insights |

Groww is being most loved by side Hustler

B. Power/Core/Casual Segmentation:

User Type | Casual | Core | Power |

Usage Characteristics | - Explores basic investment options like mutual funds or SIPs - Orders/invests occasionally, driven by external factors like trends or peers | - Explores diversified products like stocks and mutual funds - Invests bi-weekly or monthly based on market insights | - Actively trades across multiple asset classes (stocks, crypto, options) |

Recency of Use Case | - Last investment > 3 months ago | - Invests at least once in the past month | - Invests/trades almost daily |

Natural Frequency | - Once every 1-2 months | - Bi-weekly or monthly | - Daily or multiple times a week |

Monetary/AOV/Revenue Generated | - AOV ~Rs. 3,000-5,000 per investment | - AOV ~Rs. 10,000+ per investment | - AOV ~Rs. 50,000+ per investment |

Pain Points | - Lack of advanced insights - Uncertainty about returns - Fears market volatility | - Needs reliable, moderate-risk investment products - Seeks simple but effective tools for portfolio management | - Seeks in-depth analytics and faster trade execution |

Valued Features | - Easy-to-use interface - Educational content - Basic investment tracking | - Market news and updates - Portfolio management tools - Insights on different asset classes | - Real-time data analytics |

Core Value Proposition (CVP) Being Utilized | - Simplified access to mutual funds and SIPs - Low-risk, easy investments | - Diversified investment options with moderate risk - Tailored market insights and analysis | - Advanced trading tools with in-depth analytics |

JTBD of the Persona | - Secure low-effort investments - Test the waters in the stock market - Build savings | - Manage a balanced portfolio - Achieve moderate returns - Secure future goals (e.g. retirement) | - Maximize returns and grow wealth |

Discovery | - Influenced by social media or peers - Introduced to the platform via referrals & google ads | - Consumed market reports or finance-related news - Referred by a financial planner | - Engaged with multiple financial channels |

Level of Engagement | - Low, occasional checking of portfolio - Rarely interacts beyond initial setup | - Medium, engages bi-weekly with insights - Regular monitoring of portfolio and trends | - High, daily engagement with trades |

Product hook Strategy

Engagement Hook Strategies for Groww

Product Hook 1: Groww News Feed

Goal: Increase daily engagement by keeping users updated with real-time market news, investment insights, and personalized financial updates.

Problem Statement: Users often miss crucial market updates or new investment opportunities, limiting their engagement and growth potential within the platform.

Current Alternative:

- Users rely on external news apps or websites to stay informed, leading to fragmented experiences and potential missed opportunities on Groww. Ex - Moneycontrol, Ticker Tape, Screener, etc

Solution: Groww News Feed

- Personalized News Feed: A curated, real-time stream of market updates, financial news, stock recommendations, and articles tailored to the user’s interests and portfolio.

- Daily Updates: Ensure users are always up-to-date with breaking market news, stock movements, and financial trends.

- Learning Resources: Include quick guides and tips on how to maximize investments, which cater to casual, core, and power users alike.

- Push Notifications: Send timely notifications when there are major market changes that affect the user’s portfolio, helping them make informed decisions promptly.

- Free Access: Available to all users without any subscription fees to ensure that staying informed doesn’t come with a cost barrier.

Success Metrics:

- Increase in daily app sessions.

- Growth in user engagement (time spent in the app) due to news consumption.

- Positive user feedback on the value of personalized news and updates.

Other Metrics to Track:

- Click-through rates on news articles.

- Retention rates among users engaging with the news feed.

- Impact on investment activity after engaging with news articles.

- Feedback on content relevance and utility.

Groww can consider keeping some articles free for users and some paid

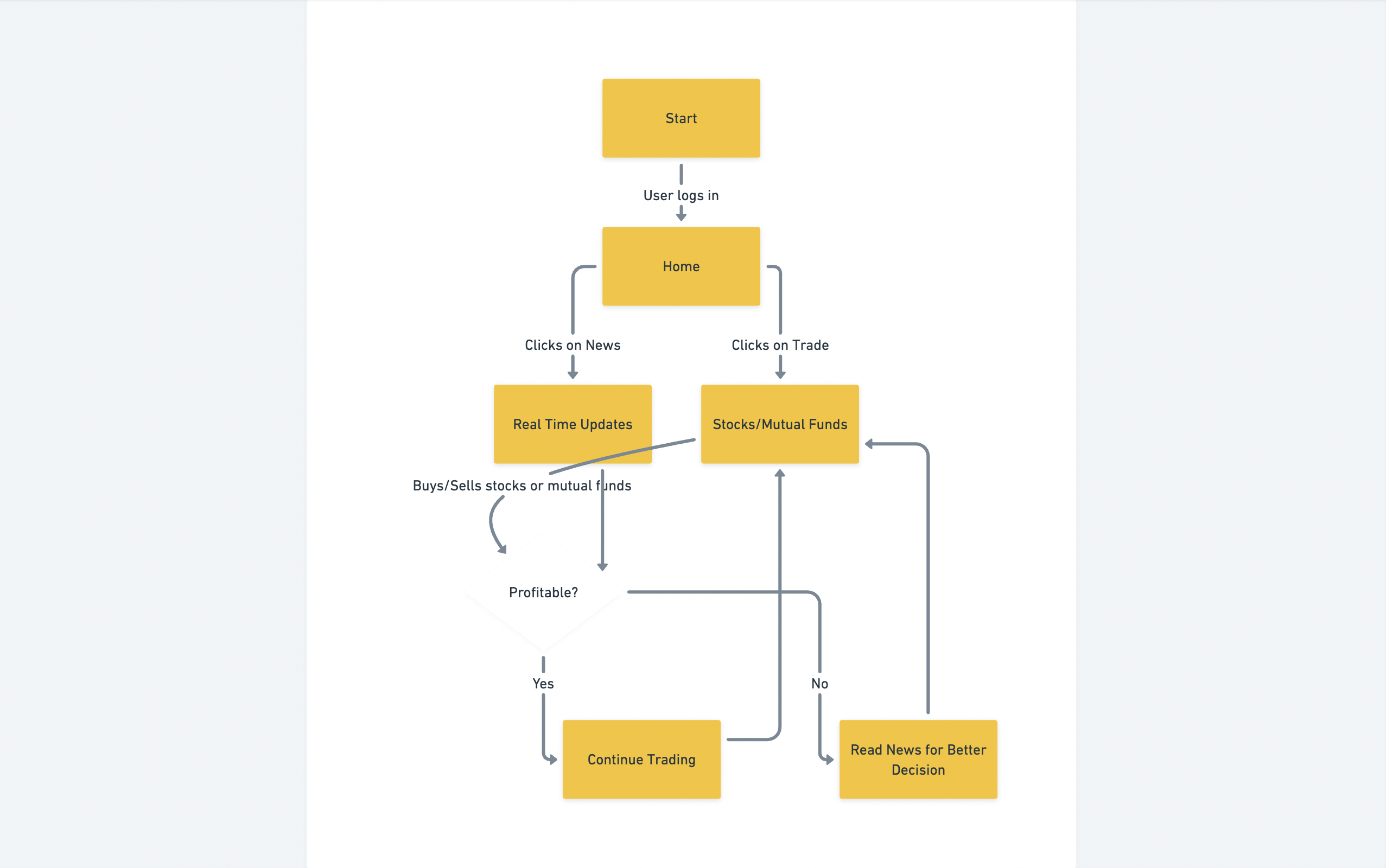

New User flow

🪝 Product Hook 2: Groww Performance Insights Summary (Weekly/Monthly/Quarterly/Yearly)

Goal: Improve user engagement by providing free, periodic performance reports that give insights into their investment journey, portfolio performance, and key market updates.

Problem Statement: Core users don’t consistently track their portfolio performance or understand the overall impact of their investment choices, leading to lower engagement and missed opportunities to optimize their strategies.

Current Alternative:

- Users check their portfolios on an ad-hoc basis without receiving consistent feedback or insights into their long-term progress.

- They may manually calculate their returns or rely on other apps to view their portfolio performance.

Platforms like Dezerve monitor, and ET money come here

Solution: Groww Performance Insights/Summary

- Weekly/Monthly/Quarterly/Yearly Reports: Automatically generated reports summarizing the user’s portfolio performance, returns, and market trends, sent directly to their inbox or WhatsApp as in-app notifications.

- Tailored Insights: Provide personalized insights and recommendations based on the user’s investing habits, including missed opportunities and strategies to optimize their portfolio.

- Performance Comparisons: Show how their portfolio performed relative to the market and similar investors over different time frames.

- Automated Recommendations: Offer suggestions for improving performance, such as diversifying investments, exploring underperforming sectors, or adjusting risk exposure.

- Accessible to All Users: Free of charge, encouraging both casual and core users to stay more engaged without needing to pay for premium features.

Success Metrics:

- Increase in the number of users regularly reviewing their performance reports.

- The open rate of reports

- Growth in user retention and app engagement due to insights and recommendations.

- Positive feedback on the usefulness of the performance reports.

- Diversification post the performance insights

Other Metrics to Track:

- Rate of improvement in user portfolios after receiving performance insights.

- Click-through on Stocks/SIP/ETF/Mutual funds rates on recommendations provided in reports.

- Retention rates of users engaging with the performance reports.

- Feedback on report clarity, utility, and presentation.

User Flow: Groww Performance Insights

Engagement Campaign

Campaign | Hypothesis | Channel of Distribution | Persona/Type of User | Theme | Target Feature | Pitch and Content | Goal of the Campaign | Details | Offer | Frequency and Timing | Success Metrics | Milestones for the Campaign |

Campaign 1: SmartPath Guided Investment | Introduce casual users to personalized financial goals via Groww SmartPath to build awareness and repeat investments | Push Notifications (PN), Email, App Banners, Social Media | Casual Users/New Investors | Financial Goals | Groww SmartPath | “Build Your Personalized Smart Investment Plan in 3 Easy Steps!” | Convert casual users into core users by increasing engagement with SmartPath | Digital campaign where casual users will be guided to explore SmartPath | Free investment consultation for first SmartPath setup | Once a week for 3 months | No. of users completing SmartPath setup, engagement rates | Initial conversion to SmartPath setup → Follow-up engagement in first 15 days of setup |

Campaign 2: Performance Insights for Core Users | Improve retention of core users by offering insights on investment performance, encouraging them to diversify | Email, WhatsApp, App PN | Core Users/Regular Investors | Performance Summary | Groww Performance Insights | “Track Your Portfolio Performance & Get Suggestions for Growth!” | Convert core users into power users by helping them diversify their investments | Users will be nudged to review performance and invest further | Free consultation for portfolio diversification after reviewing performance insights | Bi-monthly | No. of users engaging with insights, no. of investments made after insights | Track portfolio review in the first 7 days → Measure incremental investments in 30 days |

Campaign 3: News Feed for Market-Savvy Power Users | Drive deeper engagement with power users by integrating them into a community and real-time news feed | In-App Notifications, Email | Power Users/High Net-worth Investors | Market Insights | Groww News Feed | “Stay Ahead with Real-Time Market News Tailored to Your Investments” | Strengthen engagement and make power users the brand advocates | Power users will get real-time news, updates, and special market events related to their portfolio | Early access to premium features in News Feed for the first 3 months | Weekly | No. of users engaging with news feed, CTR from notifications | Continuous engagement after the first market news update → Track retention over 90 days |

Campaign 4: SmartPath Milestone Rewards | Encourage long-term engagement by rewarding users who hit specific investment milestones via SmartPath | Email, App PN, In-App Banner | Core Users, Casual Users on SmartPath | Milestone Rewards | Groww SmartPath | “Hit Your First Milestone and Unlock Special Rewards!” | Increase recency and frequency of investments by gamifying the experience | Core and casual users will receive rewards after hitting milestones (e.g., first 10k investment) | Cashback on investments upon reaching milestones | Triggered when milestones are hit | No. of milestones completed, engagement with SmartPath | Initial milestone engagement → Retention over next 30 days after rewards |

Campaign 5: Referral Program via Power Users | Leverage power users to bring in new users through referrals, increasing overall engagement | Email, WhatsApp, App Banner | Power Users/Advocates | Social Influence | Groww Referral Program | “Refer Friends & Earn Rewards - They Get ₹200 off on First Investment” | Increase new user acquisition while engaging power users | Power users will be incentivized to share Groww and earn referral bonuses | ₹200 off for new users and ₹500 cashback for referrers on their next investment | Once a month for 6 months | No. of referrals generated, no. of new users registered | Track referral activity in the first 30 days → Ramp up based on success rates |

Visual Flow

App flow

This isn’t the best one you could find; not from a professional editor.

Retention Design

Birds Eyes View

Note - Retention rate is considered based on category everage/ estimation & user calls

March 23-24 | Total Users | Activity | Retention % |

|---|---|---|---|

Total users on Progam | 300 | Very high | |

Active - Month 1 | 170 | Very High - High | 56.67% |

Active - Month 2 | 160 | High - medium | 53.33% |

Active - Month 3 | 152 | Medium - Low | 50.67% |

Active - Month 6 | 131 | Medium - Low | 43.67% |

Active - Month 12 | 106 | Low - Zero | 35.33% |

Numbers are considered based on Casual, Core, and Power users

Core & Power users have the highest retention as they operate in the market have a fair understanding and also follow it as a full-time source of income

Observation: Casual Users initially engage actively with the app, especially during the first month as they explore investment options and educational content. However, activity tends to drop as users either plateau in their learning curve or lose interest due to market volatility or other external factors especially if they face some loss they tend to stop using the app.

Microscopic View

Key Retention Drivers:

- Educational Content Engagement:

- Offering regular, updated content that resonates with the current market trends.

- Personalized recommendations based on user portfolio and interests.

- Investment Activity:

- Users who make at least one investment per month tend to stay active longer.

- Encouraging periodic investments through reminders or curated portfolios.

- Updating them with daily news such as Big stock deals, Companies received XYX orders, Sector knowledge

- Once a person starts seeing some profit he tends to stay over the app more, advisors should be provided for casual users for better returns

- Community Interaction:

- Building a community feature where users can discuss strategies or market trends.

- Facilitating user-generated content to foster engagement.

Core Feature Retention Analysis:

| Core Offerings | Retention |

|---|---|

Direct Stock Investment | High retention for users who actively monitor the market |

Mutual Funds | Moderate retention, as users tend to set and forget their investments |

Educational Webinars | High retention when users are consistently engaged |

Portfolio Tracking | High retention for users who monitor their portfolios regularly |

SIP (Systematic Investment Plan) | High retention due to the recurring nature of investments |

Advisory Services | High retention for users who seek professional guidance |

News Update | High retention for Casual & Core users |

Reasons for Churn

| Voluntary | Involuntary |

|---|---|

Lack of personalized investment recommendations | Financial Constraints |

Market downturns leading to loss of interest | Inability to maintain SIP contributions due to financial constraints |

Lack of new and engaging content | Payment or transaction failures |

Poor customer support experience | Account closure due to inactivity |

High Brokerage Fees | Account/ Bank Verification Issues |

Limited Investment Options | |

Less technical features available | |

Technical Glitches | |

Negative Actions to Look Out for Pre-Churn

- Decrease in login frequency - Users are less engaged with the platform.

- Reduction in the number of transactions - Indicates a loss of interest or confidence in the platform.

- Drop in educational content engagement - Users are not interacting with learning resources.

- Unsubscribing from newsletters or notifications - Users are distancing themselves from the platform.

- Increased support queries without resolution - Users are frustrated with unresolved issues & app technical glitches due to which users are facing huge losses

- Time Spent - User dropping off from the app based on the segment (Casual/Core/Power) faster than average time

- Exploring - Users start exploring less investment opportunities

Resurrection Campaign

| Campaign Focus | Target Segment | Objective | Channels | Key Actions | Success Metrics |

|---|---|---|---|---|---|

1. In-App News Integration | Users showing reduced engagement with the app | Increase daily active users by providing relevant market updates directly in the app | In-App Notifications, Email | - Daily personalized financial news - Push notifications for breaking news relevant to their portfolio - Weekly market summaries | - Increased daily active users - Higher open rates for push notifications - Time spent on the news section |

2. Portfolio Management Enhancements | Users with stagnant portfolios or minimal trading activity | Encourage more active portfolio management by providing actionable insights | In-App Notifications, Email | - Portfolio rebalancing suggestions - Alerts on underperforming stocks - Recommendations on diversification | - Increase in portfolio activity - Higher trading volumes - Reduced portfolio stagnation |

3. AI-Driven Analysis | Users with complex portfolios or low financial literacy | Provide personalized AI-driven analysis to help users make informed decisions | In-App, Email, WhatsApp | - Automated insights based on user portfolio - AI-driven recommendations for investments - Alerts on missed opportunities | - Increase in the number of trades - Higher satisfaction rates in user surveys - Reduced customer support queries related to investment choices |

4. AI Bot for Churned Users | Users who churned due to technical issues or lack of engagement | Re-engage churned users by addressing their pain points with AI-driven assistance | WhatsApp, Email, In-App | - AI bot to identify and resolve technical issues - Personalized reactivation offers based on past behaviour - Step-by-step guides for using app features | - Number of reactivated users - Reduction in technical support tickets - Increase in post-reactivation engagement |

5. Personalized Financial Coaching | Users at risk of churn due to lack of financial knowledge | Offer tailored financial coaching to help users achieve their financial goals | In-App, Email, WhatsApp | - One-on-one sessions with financial advisors - Personalized financial plans - Regular follow-ups and progress tracking | - Increase in user satisfaction - Higher retention rates - Improved user confidence in managing their finances |

6. Portfolio Insights for Dormant Users | Users who have not interacted with the app for over a month | Re-engage dormant users by providing insights into potential gains or missed opportunities | In-App, Email, SMS | - Notifications on missed opportunities - Alerts on market movements related to their portfolio - Exclusive offers for re-engagement | - Reduction in dormant users - Increased portfolio activity - Higher open rates for re-engagement campaigns |

7. Weekly Summary Campaign | Core and Power Users | Keep highly engaged users informed and involved with their portfolio's performance | In-App, Email, WhatsApp | - Weekly summary of portfolio performance - Insights on market trends relevant to their investments - Suggestions for next steps or potential trades | - Continued high engagement - Increased portfolio activity - Positive feedback on summaries |

Post this campaign - All users will just be

The goal is to encourage users to make better decisions within the app, enhancing their engagement and reducing the likelihood of them leaving the app to seek alternatives.

Let's Groww together

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.